Learning in the Auditing Profession: A Framework and Future Directions

Accounting, Organizations, and Society, Forthcoming

Co-authored with Bart Dierynck and Kathryn Kadous

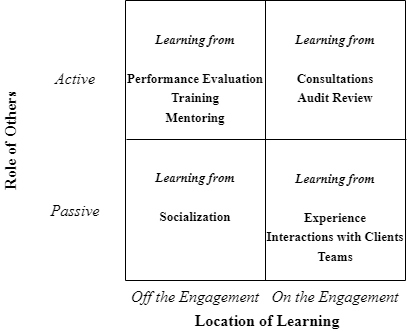

Abstract: Drawing on literature in auditing and workplace learning, this paper develops the Auditor Learning Framework. The Auditor Learning Framework distinguishes auditor learning processes along two dimensions: the location of learning (on-the-engagement or off-the-engagement) and the role of others in the learning process (active or passive). We review the auditing literature and classify papers that directly or indirectly enhance our knowledge of auditor workplace learning into our framework to identify gaps in our understanding of the auditor learning processes. Our study provides a comprehensive view of auditor learning processes and provides suggestions for future research.

Auditor Automation Usage and Professional Skepticism

Job Market Paper

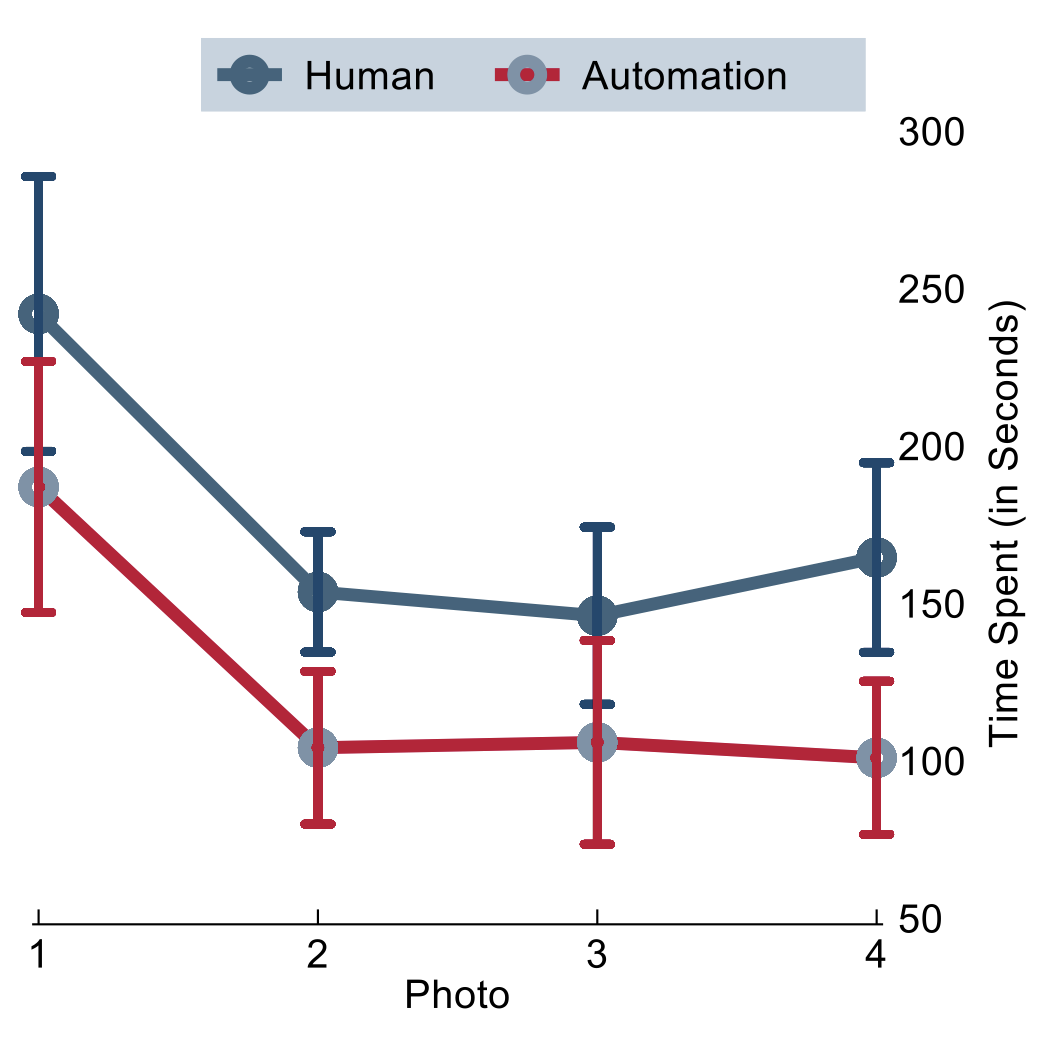

Abstract: Audit firms are using automated tools and techniques with the aim to improve audit effectiveness and efficiency. However, regulators have expressed concerns that auditors may rely too much on these automated tools, which could reduce professional skepticism. Using an experiment, I predict that auditors are subject to automation bias and may use automated cues as a heuristic replacement for seeking information and thereby reduce professional skepticism. To mitigate the negative effects of automation on skepticism, I employ a counterarguing mindset intervention based on psychology theory. The study also tests whether the reduction in professional skepticism caused by automation usage spills over to subsequent tasks but do not find any evidence of such an effect.

Presentations (includes scheduled): Tohoku University, ISAR Conference in Sydney, Australia; EAA Annual Congress in Helsinki, Finland; University of Alberta; Nanyang Technological University; Radboud University; Vrije Universiteit Amsterdam; Universiteit van Amsterdam; IE Madrid; WHU - Otto Beisheim School of Management; FAR Academic Research Seminar in Maastricht, NL; KU Leuven; AAA / Deloitte Foundation / J. Michael Cook Doctoral Consortium in Westlake, TX; ENEAR 2022 Doctoral Colloquium in Seville, Spain; EAA 38th Doctoral Colloquium in Osøyro, Norway; Tilburg University.

Auditor Task Prioritization: The Effects of Time Pressure and Psychological Ownership

Co-authored with Bart Dierynck

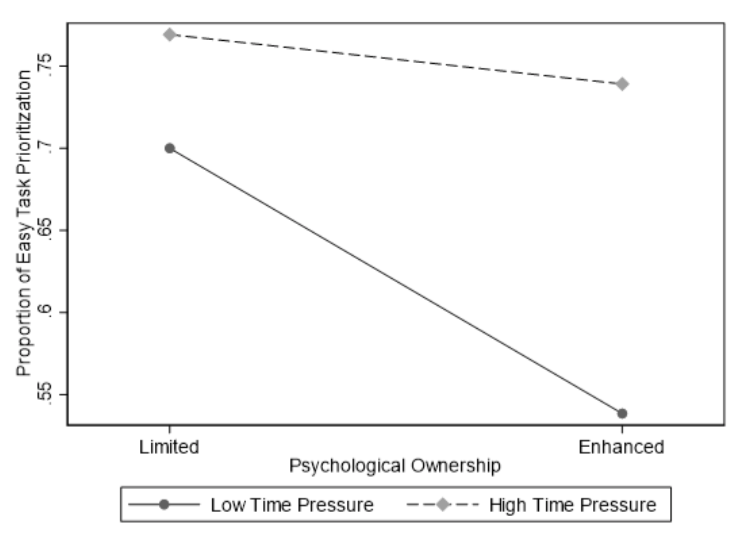

Abstract: This paper reports three studies examining easy task prioritization among auditors. The first study is a survey of auditors providing evidence that auditors perceive easy task prioritization to be a threat to audit quality, yet auditors do expect other auditors to prioritize easy tasks. In our first experiment, we find that auditors indeed prioritize easy tasks. Easy task prioritization is also exacerbated under time pressure. We further find that psychological ownership is only able to alleviate easy task prioritization in low time pressure conditions, but not in high time pressure conditions. In our second experiment, we find that prioritizing the easy task leads to lower judgment performance, and by extension, audit quality. The performance detriment of easy task prioritization manifests itself in the difficult task, and in particular in finding errors for which more cognitive processing is needed. Combined, our studies document easy task prioritization in auditing, the audit quality implications, and the role of time pressure and psychological ownership.

Presentations (includes scheduled): 2023 AAA Auditing Midyear Meeting in Austin, TX; Tilburg University; Tilburg GSS Seminar; Bristol University*; 8th EIASM Workshop on Audit Quality (virtual); EAA Annual Congress 2021 (virtual); Dutch Junior Accounting Meeting (virtual); FAR Academic Research Seminar; 11th EARNet Symposium (virtual); KU Leuven; 2022 ENEAR Conference in Seville, Spain.

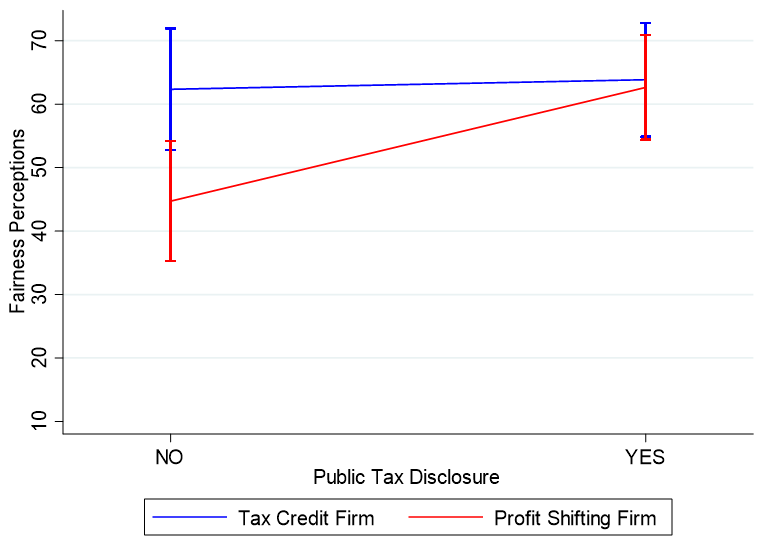

Public Tax Disclosures and Fair Share Perceptions

Co-authored with Bart Dierynck, Martin Jacob, Maximilian Müller, and Victor van Pelt

Abstract: To reveal whether firms pay their fair share of taxes, regulators increasingly mandate public tax disclosures. Such disclosures are often assumed to raise awareness and scrutiny of firms’ tax aggressiveness and should thus help stakeholders identify aggressive tax avoiders. We conducted two experiments to test this assumption. The first experiment indicate that stakeholders become worse at identifying aggressive tax avoiders when public disclosures focus on bottom-line tax numbers. The reason is that stakeholders use such disclosures as a heuristic for a firm’s tax aggressiveness and are reluctant to acquire complementary, more detailed tax information. The results of the second experiment demonstrate that policies to counteract the adverse effects of public tax disclosures (i.e., a disclaimer, more detailed public tax information, and country-by-country reporting) are helpful but none can achieve the actual policy goal of improved identification of aggressive tax avoiders.

Presentations (includes scheduled): 2nd Dutch Corporate Tax Workshop in Rotterdam, NL; Tilburg University; WHU - Otto Beisheim School of Management*; EAA VARS*; 10th EIASM Conference on Current Research in Taxation; George Mason University Behavioral Tax Symposium; 44th EAA Annual Congress in Bergen, Norway.

Media coverage: The Financial Times, WHU Knowledge

Corporate Tax Planning and Industry Concentration

Co-authored with John Gallemore, Jesse van der Geest and Martin Jacob.

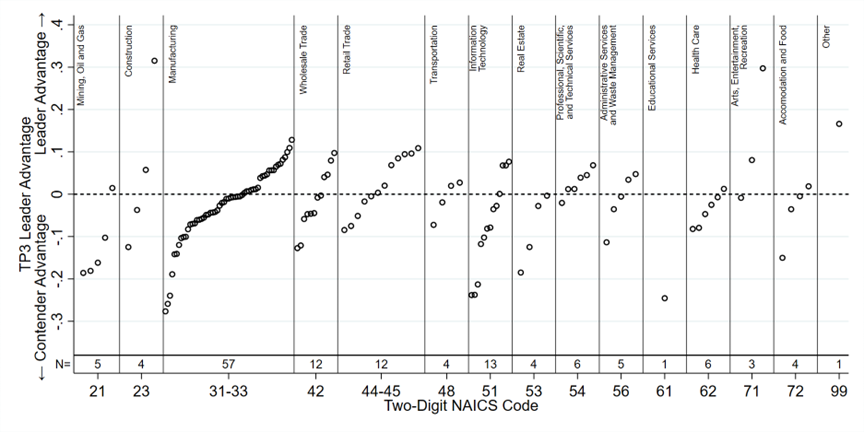

Abstract: Recent research has documented that industry concentration has increased significantly over the past 25 years, with potentially negative consequences for competition, productivity, and social welfare. Some have suggested that greater corporate tax planning by industry leaders, which can provide them with a cost advantage over their competitors, has contributed to this trend. As a result, policymakers are targeting such tax planning to reduce industry concentration. We provide large-sample empirical evidence on whether tax planning is associated with industry concentration. In contrast with conventional wisdom, we find that industry leaders generally do not exhibit greater tax planning relative to their closest competitors. Furthermore, industry leader tax planning advantages do not meaningfully explain the trend in industry concentration over our sample period. Finally, we document that industries with plausibly tax planning-induced concentration do not exhibit different aggregate productivity growth than other industries. In short, our findings cast doubt on the idea that corporate tax planning is responsible for increasing industry concentration or other anti-competition industry-level outcomes in recent years.

Presentations (includes scheduled): Tilburg GSS Seminar; Tilburg University*; 2nd Norwegian Tax Accounting Symposium in Bergen, Norway*; 44th EAA Annual Congress in Bergen, Norway*; 12th EIASM Conference on Current Research in Taxation (virtual), Dutch Junior Accounting Meeting in Rotterdam, NL*.

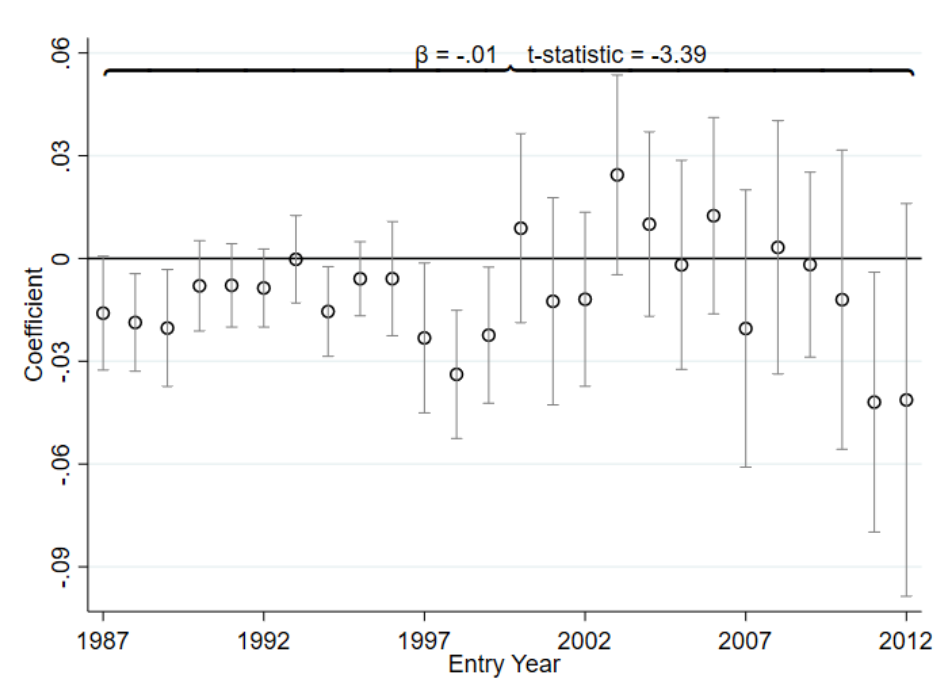

Survival of the Tax Fittest: Path Dependence in Corporate Tax Planning

Co-authored with Jesse van der Geest and Martin Jacob.

Abstract: We investigate the potential of path dependence in explaining cross-sectional variation and persistence in efficient corporate tax planning. Variation in tax planning efficiency among firms is far from being fully understood. We propose that corporate tax planning strategies are path dependent. This implies that once a business strategy is adopted, this narrows the range of tax strategies available to the firm. Once a more efficient tax planning strategy emerges, path dependence hampers firms from adopting that option, potentially resulting in tax planning inefficiencies. We compare new entrants to a market with incumbent firms, and find that new entrants have an Entrant's Tax Edge. That is, new entrants are more efficient in tax planning compared to incumbent firms. Consistent with our predictions and path dependence theory, we find that the Entrant's Tax Edge is amplified when incumbent firms in the market are relatively inflexible. Finally, we explore whether new entrants use their tax edge as a competitive mechanism. We find new entrants only outperform incumbents in tax planning efficiency when competition is high, but not when competition is low.

Presentations (includes scheduled): 6th Berlin-Vallendar Tax Conference (Early Papers)*; Tilburg University; Tilburg GSS Seminar.

Asterisk indicates presentation by co-author.